Sizing the BTC Basis Trade

Understanding the Mechanics and Market Impact of Bitcoin's Largest Arbitrage Trade

TL;DR

U.S. bitcoin ETF fund data and CME open interest (OI) data suggest that basis trading accounts for, on average, 16.7% of ETF assets under management (AuM), much lower than the 25% put forth by some market participants, indicating that the large majority of flows represent real spot demand

Since the launch of U.S. spot BTC ETFs, approximately $45 billion in net new long spot exposure has been added to the market, far exceeding the basis trade activity as measured by changes in futures open interest

While some popular views suggest that the outstanding spot ETFs that are leveraged for the basis trade cannot be seen as true inflows, we believe that the majority should be seen as true inflows because the spot ETF is used as a conduit to the bitcoin futures-based ETF inflows and therefore should be considered as genuine demand for bitcoin exposure through a chain of financial intermediation

As natural buyers of bitcoin futures, derivatives-based BTC ETFs have also represented a significant share of open interest thus creating a structural bid that, all things being equal, widens the basis and creates opportunities for arbitrage

Introduction

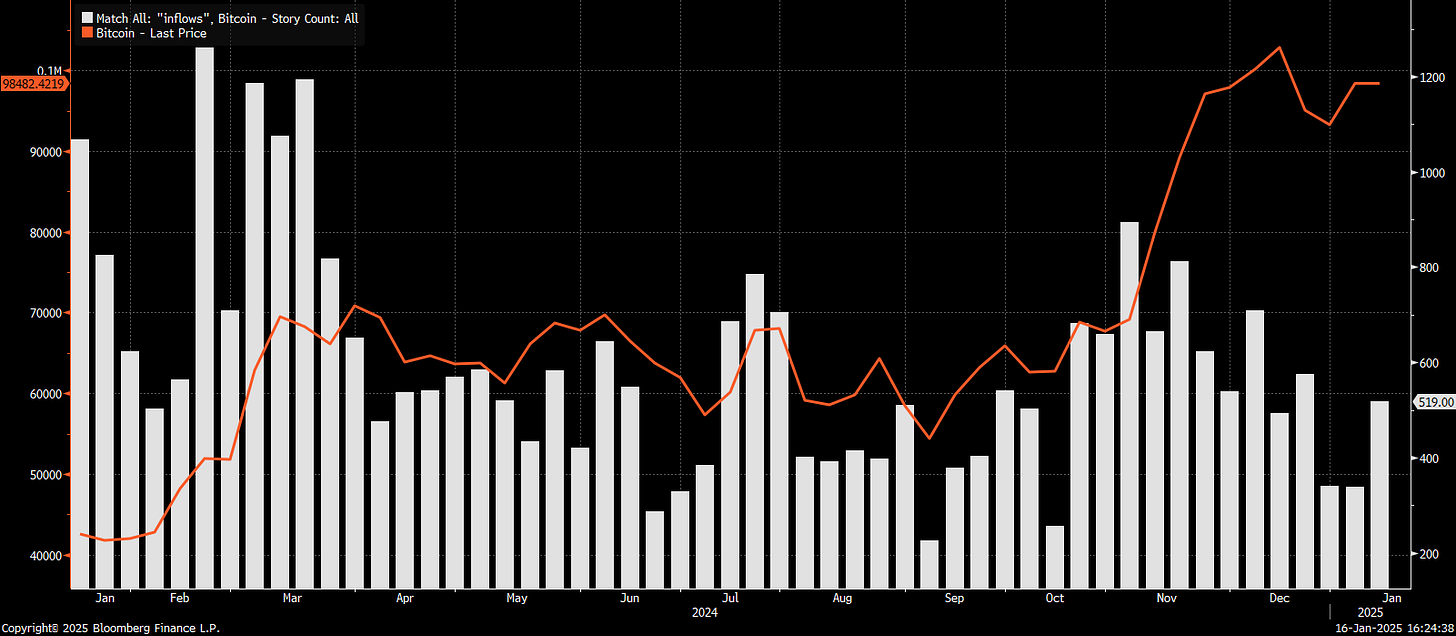

Since the U.S. Securities and Exchange Commission approved spot bitcoin ETFs on 10 January, 2024, the market has closely tracked and scrutinized net flows and changes in AuM to gauge investor sentiment and adoption.

For good reason.

The launch of bitcoin spot ETFs in the U.S. stands out as one of the most significant ETF launches in history, not just for its record-breaking numbers, but because it represented an evolutionary leap in the integration of traditional and digital asset markets.

Excluding Grayscale, the “Newborn Nine” spot ETFs, launched by ARK 21shares, Bitwise, Fidelity, Hashdex, Invesco Galaxy, iShares, Valkyrie, Vaneck, and Wisdomtree amassed $879.7 million in assets on the first day of trading on 11 January, 2024 and reached $3.2 billion within the first five days. By the end of the month, that number more than doubled to $7.3 billion.

Since their introduction, the entire bitcoin spot ETF category now houses over $110 billion worth of assets, or 1.13 million bitcoin, which is around 5.7% of the approximately 19.8 million bitcoin currently in circulation. For context, these U.S. spot ETFs are already on track to surpass the bitcoin initially mined by Satoshi Nakamoto in the first 22,000 blocks after the network was launched.

At the end of 2024, we published a comprehensive look-back at the entire crypto ETP market. You can read it here.

Apart from scoreboard-watching fund flows, market participants have also focused on discerning institutional adoption via quarterly 13F disclosures and the relationship between the basis trade and spot flows to evaluate genuine demand. This article aims to examine the latter topic in more detail.

We will approach the basis trade in two ways:

First, we will dig into aggregate fund flows and futures OI data to understand their relative scale in order to estimate the size of the carry trade.

Secondly, we will try to explain mechanistically why the basis trade isn’t necessarily zero-sum with respect to spot flows and can, in fact, act as a conduit of organic demand for long BTC exposure.

Those of you who are familiar with the basis trade can skip the following section explaining the basics.

What is the basis trade?

The basis is simply the difference between the spot price of an asset and the price of its corresponding futures contract. This difference becomes tradeable when one simultaneously holds opposing positions.

Firstly, a quick fresher on some terminology:

Spot is likely the type of asset most market participants will be familiar with and it is essentially a financial instrument, asset, or commodity that is available for immediate delivery and settlement in the spot market.

Futures, on the other hand, are financial contracts which allow counterparties to agree on buying or selling an asset, security, or commodity at a set price and future date. At expiration, the parties either exchange the actual underlying asset or exchange the difference in cash between the contract price and the spot price of the asset.

Expressed as the difference between the futures and spot prices, this means that the basis can be either negative or positive.

A positive basis exists when the futures price exceeds the spot price. This condition is known as contango.

A negative basis occurs when the spot price exceeds the futures price. This condition is known as backwardation.

When basis is positive, arbitrageurs can profit by buying the spot asset and selling futures contracts, thereby locking in the positive basis as the futures price converges toward the spot price at expiry. When basis is negative, traders can profit by selling the spot asset and buying futures, anticipating that the basis spread will widen.

What drives the basis? While a thorough and complete explanation is beyond our scope, it fundamentally comes down to supply and demand. The dynamics in both spot and futures markets determine how profitable it becomes for arbitrageurs to step in and either narrow or widen the basis spread.

It is important to note that the basis trade is nothing new and is a well-established arbitrage strategy in traditional finance where sophisticated market participants are constantly searching for such opportunities which, in turn, results in the narrowing of basis and reduction in the potential profit that can be extracted from these strategies.

For context, as of January 2024, the U.S. Federal Reserve estimated that the Treasury cash-futures basis trade volumes of approximately $317 billion.

In crypto, the basis trade has long existed but remained relatively inaccessible to institutional participants due to a several limitations, including product access, illiquidity, exchange counterparty risk, capital inefficiency, and regulatory compliance.

The launch of U.S. spot bitcoin ETFs transformed this landscape, giving institutional players, especially in the U.S, home to the most mature and liquid markets, a way to execute the basis trade in way that met their requirements.

Sizing the basis trade

For our analysis, we began by comparing daily OI data for the next three CME BTC futures against the total AuM of the ten largest U.S. spot ETFs.

For simplicity, we assume that 100% of that aggregate OI is engaged in basis arbitrage. In reality, not all of OI is engaged in this sort of activity. However, making this assumption provides us with a conservative ceiling for our estimate.

Here we observe that, since the day spot bitcoin ETFs were launched in the U.S., the basis trade as a percentage of ETF shares outstanding has been relatively small. Over the last year, OI’s share of AuM has ranged between ~15% and ~20% with a longer-term average of 16.7%. This is a long way from commentary speculating that fund flows as purely basis trade-driven and, thus, not reflective of genuine demand.

Next, we compare OI share of AuM to annualized basis. Here we observe that both exhibit range-bound behavior, with annualized basis fluctuating within a range of -4% and 18%.

This makes sense as arbitrageurs, reacting to market conditions and constraints like funding costs, will step in or out of the basis trade depending on its relative profitability.

Having established the basis trade as a relatively small portion of spot ETF AuM, how much net new demand has been added then?

To answer this question, we can compare daily net fund flows with daily changes in OI.

What we observe is that since the launch of U.S. spot BTC ETFs, these products have added over 514K BTC, or approximately $52.5 billion, of net new long spot exposure to the market in excess of daily changes in OI.

In other words, that is 2.6x more than the 198K bitcoin currently held by the U.S. government.

The data suggests, therefore, that a significant portion of ETF net inflows represent genuine spot demand rather than purely arbitrage-driven activities.

Our estimate of an average share of 16.7% is a far-cry from some of the commentary calling for significantly higher attribution of flows to basis trading.

This share is likely to be even lower given that not all of OI will be engaged in basis arbitrage.

Basis trade as a conduit for organic demand

Traditional financial markets rely heavily on intermediaries who perform vital functions in maintaining a liquid and well-functioning financial system.

Financial intermediaries serve multiple roles: they underwrite risk for profit, develop new risk-based products, determine pricing, warehouse risk, distribute it across markets, and manage it effectively.

It is through this network of economic actors and intermediaries that we will attempt to show how the basis trade can help reflect genuine demand for bitcoin. To do so, it makes sense to understand how derivatives-based ETFs affect the broader market.

Prior to the introduction of spot ETFs, excluding spot tokens on centralized crypto exchanges, investors in the U.S. could get bitcoin exposure either through Grayscale Bitcoin Trust product (GBTC) or one of a couple derivatives-based ETFs which held futures, other securities, and cash.

Three of the largest derivatives-based ETFs by AuM have been Volatility Shares 2x Bitcoin Strategy ETF (BITX), ProShares Bitcoin ETF (BITO), and ProShares Ultra Bitcoin ETF (BITU).

Let’s walk through the steps:

Consider an investor seeking bitcoin exposure through a derivatives-based ETF (dETF) where the product provides bitcoin exposure through underlying futures positions. In our example, the investor purchases the dETF over-the-counter (OTC) from a liquidity provider (LP).

Assuming the LP has no existing inventory of the dETF, they will then create new shares directly with the issuer and sell them to the end investor. Here, the net result is that the LP is flat while the investor is long.

To provide the intended exposure of the dETF, the issuer must then go into the futures market to buy sufficient contracts in order to create the underlying exposure of the dETF product. The net result is that the issuer is long futures and short their own dETFs, which was created and sold to the LP in the previous step.

All things being equal, as a structural buyer of futures, the issuer’s purchases exert upward pressure on futures and widens the basis. This, in turn, attracts the marginal arbitrageur to capture the basis by selling futures.

To close the loop of the basis trade, the arbitrageur will simultaneously buy an equivalent amount of spot bitcoin ETFs to offset the short futures exposure.

The key insight from this entire process is that through a chain of market intermediaries, each performing distinct functions, the initial demand for bitcoin exposure via dETFs ultimately transforms into spot demand through arbitrage activity.

While most market participants won’t necessarily think of it these in those terms, basis arbitrageurs can be thought of as conduits of organic demand for bitcoin.

To get a sense of the relative size of these natural bids resulting from futures-based ETFs, we find that even up until the day before the launch of bitcoin spot ETFs, the ProShares Bitcoin ETF (BITO) held 5,832 futures contracts expiring at the end of February (CME Bitcoin Futures Feb24). This represented a sizable 72% of the 8,040 in OI for that month’s contract.

Conclusion

In this first article, we have briefly demonstrated that a significant majority of the AuM and daily inflows represent genuine demand for bitcoin exposure. This should hopefully dispel any notions of the fund flows resulting primarily from basis arbitrage activities.

Furthermore, by walking through the mechanics of a derivatives-based bitcoin ETF and how that flows into spot ETF demand, we have hopefully shed some light on how the basis trade also acts as a key economic incentive that allows arbitrageurs to act as a conduit of that demand towards the spot market.

As the market matures and more institutional players enter the space, understanding these dynamics becomes increasingly important for traders and investors.

Disclaimer

This content (“content”) has been prepared by Flow Traders group and its affiliates (“Flow Traders”) for informational and educational purposes only. Content prepared by Flow Traders is addressed exclusively to professional and institutional investors (i.e. eligible counterparties) residing in eligible jurisdictions.

Please refer to our full disclaimer here.

can you also explain the role of perpetual futures here on arbitrageur or LP hedging? vs the standard CME futures