Strategy: The World's Most Leveraged Bitcoin Trade

How Strategy Uses Financial Engineering to Become the Largest Corporate Bitcoin Holder

TL;DR

Strategy (MSTR) owns 506,137 bitcoin (±2.40% of total supply) worth $42.8 billion, making it the largest corporate bitcoin holder with an average cost basis of $66,357 per bitcoin

The company leverages a unique strategy of raising capital through convertible notes and preferred stock, trading at a 56% premium to its bitcoin holdings due to its ability to grow bitcoin per share, or so-called “bitcoin yield”

Their "21/21 Plan" aims to raise $42 billion over 2025-2027 ($21 billion each in equity and fixed income), including targeting retail investors with new 10% coupon perpetual preferred shares

MSTR's $8.2 billion convertible note structure has minimal covenants, protecting against forced bitcoin liquidation, but annual interest and dividend obligations could reach $1.68 billion

Key risks: market conditions affecting capital raising, growing fixed payment obligations exceeding software revenue ($463.5 million in 2024), potential CAMT tax on $10 billion unrealized gains, and vulnerability to bitcoin price cycles

What is Strategy?

MSTR, formerly known as MicroStrategy, is a publicly traded bitcoin treasury company and the world's largest corporate holder of bitcoin. As of 24 March, MSTR owns 506,137 bitcoin worth $42.8 billion, representing nearly 2.4% of bitcoin's terminal supply of 21 million.

Michael Saylor and Sanju Bansal founded MSTR in 1989 as a business intelligence software company. In August 2020, the company transformed into a bitcoin treasury company by adopting bitcoin as its primary treasury reserve asset, citing bitcoin's properties as a non-sovereign store of value with appreciation potential.

On 30 October, 2024, MSTR announced its "21/21 Plan", a strategic initiative to raise $42 billion over three years, split equally between $21 billion in equity and $21 billion in fixed income securities. The company plans to raise $10 billion in 2025, $14 billion in 2026, and $18 billion in 2027.

How does MSTR accumulate bitcoin?

MSTR's strategy is to accumulate bitcoin using proceeds from debt and equity issuance, along with cash from its software business. The company aims to grow its bitcoin holdings per diluted share to achieve what it calls "positive bitcoin yield" (measured as bitcoin per share growth). This yield is calculated as the period-to-period change in the ratio of bitcoin holdings to the assumed fully diluted share count.

MSTR has proven particularly attractive to bitcoin investors because, unlike traditional bitcoin ETFs that maintain 1:1 holdings of the underlying asset, MSTR strives to increase its bitcoin holdings faster than its fully diluted shares outstanding.

Consequently, MSTR currently trades at a 56.2% fully-diluted premium to its underlying bitcoin value. This fully-diluted metric factors in the potential conversion of all outstanding convertible notes into shares.

The market has assigned a premium to MSTR's ability to increase its bitcoin holdings per share. This premium enables the company to issue convertible bonds and equity at valuations that immediately increase bitcoin per diluted share. Simply put, MSTR can grow its bitcoin holdings faster than the dilution from its capital raising activities.

MSTR's bitcoin treasury strategy follows six steps:

Raise capital through equity or debt

Use proceeds to buy bitcoin

All things being equal, as bitcoin's price rises, MSTR's share price increases, and its debt-to-bitcoin ratio decreases

MSTR's premium to its bitcoin NAV grows

MSTR leverages this premium to issue either shares or convertible bonds, based on conversion price conditions

Repeat

Until now, the vast majority of capital has been raised through convertible notes.

Through convertible note issuance, which is equivalent to selling call options on common stock, MSTR has effectively monetized its stock volatility. This approach has made the bitcoin treasury operations attractive by allowing the company to raise capital without diluting existing shareholders when the stock trades at a premium to NAV.

Additionally, the embedded conversion option enables MSTR to secure funding at lower interest rates compared to traditional debt instruments. This allows the company to time convertible note issuances with periods of high implied volatility. This financial engineering approach has been crucial in optimizing MSTR's cost of capital while building the world's largest corporate bitcoin position.

What is the risk of MSTR being forced to liquidate its bitcoin holdings?

As of 19 March, 2025, MSTR's capital structure includes $8.2 billion in senior unsecured convertible notes and $2.0 billion in preferred stock, of which $730 million convertible albeit with a 900% conversion premium.

Since MSTR's convertible notes are structured as unsecured debt and not directly collateralized by the company's bitcoin holdings, there is a significantly lower risk of price-based liquidation triggers.

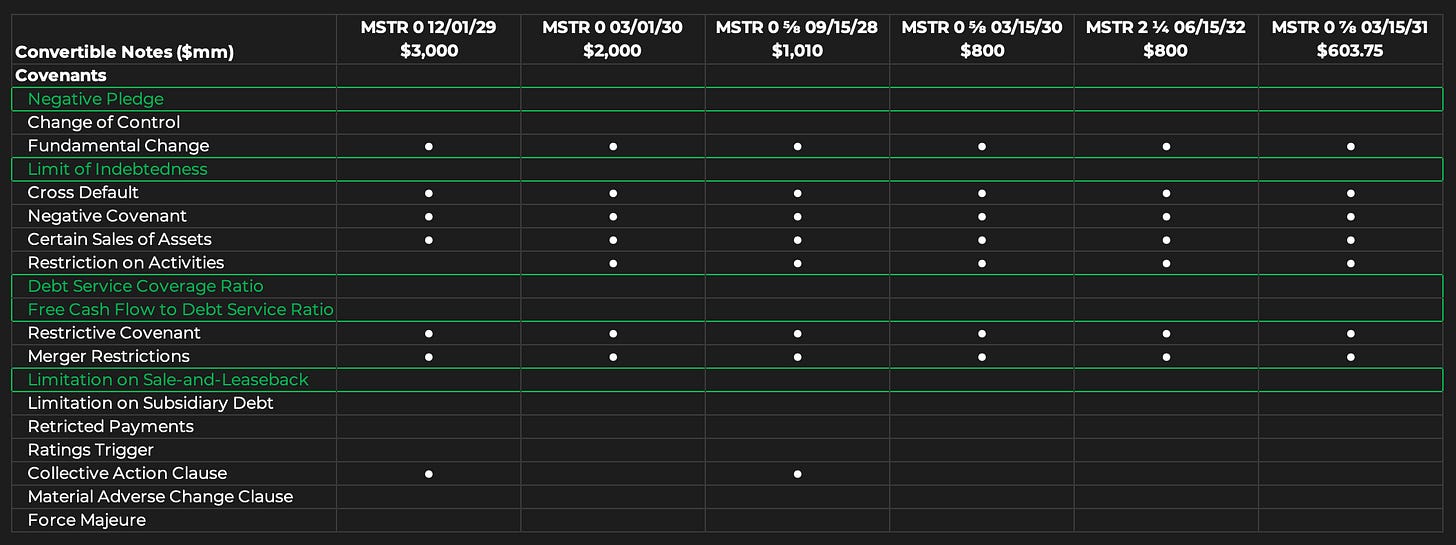

Zooming in on the covenant profiles of the outstanding convertible notes, we find that MSTR has substantial flexibility baked into its debt base. This not only reduces the risk of forced liquidation but also allows the company to leverage its bitcoin holdings for raising additional capital.

The "Negative Pledge" clause typically protects bondholders from subordination. However, MSTR's notes lack this covenant, allowing the company to pledge assets, including its bitcoin holdings, as collateral for other debt.

Additionally, MSTR is not subject to common covenants such as "Limit of Indebtedness," "Debt Service Coverage Ratio," and "Free Cash Flow to Debt Service Ratio," which typically ensure solvency and prevent over-leveraging. This freedom means MSTR won't be forced to liquidate bitcoin to maintain specific financial ratios or be restricted by debt levels.

Finally, MSTR is not bound by the "Limitation on Sale-and-Leaseback" covenant, which typically restricts companies from transferring assets and leasing them back which ultimately prevents them from offloading assets while keeping liabilities. This gives MSTR an additional avenue to raise capital using its bitcoin holdings.

In summary, MSTR's convertible note structure provides considerable operational flexibility and protection against forced bitcoin liquidation. The absence of traditional debt covenants, combined with the unsecured nature of the notes, should allow MSTR to maintain its bitcoin holdings.

What are the key risks?

Access to favorable funding conditions in capital markets

Given the size and rapid pace of MSTR's convertible note issuance, there is a risk that the market's capacity to absorb additional issuance could become strained. This could lead to less favorable terms for future issuances or potentially limit MSTR's ability to continue its aggressive capital raising strategy.

MSTR has issued $8.2 billion in convertible notes since September 2024. In 2024 alone, MSTR's $6.2 billion worth of notes accounted for 5% of full-year issuances of $119 billion in the convertible notes market. The company's dominance of the convertible markets means its success or failure could have broader implications for sentiment in this market.

There is a strong connection between MSTR's NAV premium and its ability to issue convertible debt, preferred equity, and common equity in a non-dilutive manner. If market conditions deteriorate and MSTR's premium contracts, this could impair its ability to raise capital at favorable terms across all these funding channels.

The company's ability to maintain its NAV premium is therefore crucial to its strategy of growing bitcoin holdings per share, as a lower premium could force more dilutive capital raises, result in less attractive terms for preferred share issuance, or limit its ability to access capital markets altogether.

Funding coupon and dividend payments

MSTR currently must service approximately $227.9 million in annual interest and dividend payments on its convertible notes and preferred stock. This amount remains less than half the company's 2024 software revenue of $463.5 million.

On 31 January, 2025, MSTR priced a perpetual strike preferred stock with an 8% coupon and a 900% conversion premium, a premium so high that this class of preferred stock would likely never convert into common stock. On March 10, 2025, MSTR went further by announcing its intention to raise up to $21 billion of this perpetual strike preferred stock. If MSTR finds willing buyers for the entire offering, it would face $1.68 billion in annual dividend payments, far exceeding its software business's 2024 revenue of $463.5 million.

On 18 March, 2025, MSTR announced another funding instrument for bitcoin purchases: a perpetual strife (not a typo) preferred stock with a 10% coupon that will trade alongside MSTR's common stock. Unlike previous convertible offerings marketed to institutional buyers like hedge funds which were executing the convertible arbitrage by holdings the notes and shorting the underlying equity, this new perpetual strike offering targets retail investors.

This pivot to retail investors with complex high-yield instruments raises concerns about potential mis-selling risks and investors' ability to understand the risks of perpetual preferred shares. The 10% coupon might attract yield-seeking retail investors who may not fully grasp the instrument's complexity or MSTR's highly-levered bitcoin treasury operations.

A prolonged bitcoin price decline could strain MSTR's ability to meet these fixed obligations. The company might then need to raise additional debt, issue equity, or sell bitcoin to meet these payment obligations during a severe downturn.

Corporate Alternative Minimum Tax

Under the Corporate Alternative Minimum Tax (CAMT) rules in the U.S., unrealized gains on bitcoin holdings could trigger tax obligations without requiring a sale of the assets.

If MSTR incurs significant CAMT liabilities, the company would need to either raise additional capital or sell bitcoin holdings to meet these obligations.

The company's substantial bitcoin holdings make it especially vulnerable to CAMT when bitcoin’s price has risen significantly since 2022.

With an average cost basis per bitcoin of $66,357 and a current market value of $88,000, MSTR has an unrealized gain of $10 billion (30.4%) on its bitcoin holdings. A 15% CAMT on these unrealized gains would result in a $1.5 billion tax liability.

While tax policy discussions fall outside this article's scope, Republicans are working to extend the Tax Cuts and Jobs Act (TCJA). This $1.5 trillion law, enacted in 2017, expanded corporate, state, and local tax deductions, along with standard deductions and child tax credits. With TCJA extensions estimated to cost $4.5 trillion, additional tax cuts, including CAMT reductions, appear unlikely to be prioritized.

Leverage and pro-cyclicality

At a macro level, MSTR's strategy relies on continuously leveraging its premium to NAV to raise more capital and buy more bitcoin, creating a pro-cyclical dynamic.

In a market downturn, this could create a downward positive feedback loop where falling bitcoin prices reduce MSTR's ability to raise capital at favorable terms, potentially leading to higher costs of capital and/or reduced ability to accumulate bitcoin.

Unlike bitcoin ETFs which have creation/redemption mechanisms to keep their price close to NAV, MSTR shares could potentially trade at a significant discount if market sentiment turns negative, similar to how GBTC traded at a -48.8% discount in November 2022 before its conversion to a spot ETF.

Conclusion

MSTR has leveraged its first-mover advantage and favorable market conditions into a self-reinforcing cycle, where rising bitcoin prices, increasing share values, and accommodative capital markets have amplified each other.

But current market conditions present challenges for MSTR.

Rising interest rate volatility and risk-aversion, driven by weakening fundamentals and U.S. tariffs, are creating headwinds for raising capital. Analysis of the Bloomberg US Corporate High-Yield Average Option-Adjusted Spread shows that increases in implied equity and interest rate volatility since 2020 have raised borrowing costs for sub-investment grade companies, a trend that would likely increase MSTR's cost of capital.

For MSTR to execute its ambitious 21/21 Plan of raising $42 billion over three years, it must carefully balance market perception and maintain its premium to NAV while navigating these challenging financial conditions.

The company faces a critical test as market volatility rises and credit conditions tighten, potentially affecting both its capital-raising capabilities and premium valuation.

The future success of MSTR's bitcoin accumulation strategy hinges on:

Maintaining investor confidence and the NAV premium

Managing borrowing costs

Navigating potential regulatory challenges, particularly around CAMT

Sustaining momentum in bitcoin price appreciation to support the reflexive dynamic

Disclaimer

This content (“content”) has been prepared by Flow Traders B.V. and its affiliates (“Flow Traders”) for informational and educational purposes only. Content prepared by Flow Traders is addressed exclusively to professional and institutional investors (i.e. eligible counterparties) residing in eligible jurisdictions.

Please refer to our full disclaimer here.