The ICO Is Dead, Long Live the ICO

Reviving Public Token Sales with Regulation, Reputation, and On-Chain Innovation

TL;DR

ICOs are making a strong comeback in 2025, driven by regulatory clarity from the SEC and MiCAR, as well as frustration with private VC rounds that lock out communities and inflate valuations.

Platforms like Legion, Echo, Hyperliquid, and Kaito are leading a new wave of community-centric, compliant fundraising. Legion uses merit-based access and reputation scoring; Echo enables decentralized syndicates; Hyperliquid and Kaito are pioneering new launch and distribution models.

Community sales and fair launches could potentially replacing airdrops and low-float/high-FDV launches, giving retail investors earlier and more equitable access while aligning incentives for long-term engagement.

New regulatory frameworks (SEC’s safe harbor, MiCAR in Europe) are in development and already influencing industry behavior by pushing platforms to adopt robust KYC/AML and disclosure standards.

The Return of the ICO

In crypto, narratives don’t die, they evolve.

Eight (long) years after their peak, Initial Coin Offerings (ICOs) and fair fundraising mechanisms are making a quiet but meaningful comeback. Projects like Legion, Echo, Buidlpad, and even AI-driven token launches are reimagining the fundraising process for a new cycle, one that may leave the high-FDV, VC-dominated meta behind.

The timing is far from random. A shifting regulatory landscape in the U.S., including a Trump-era Securities and Exchange Commission (SEC) already softening its stance and revived proposals for token “safe harbor” periods, is creating space for crypto project teams to reintroduce public token sales. At the same time, retail frustration with gated access, airdrop farming fatigue, and centralized control has pushed the market back toward models that reward alignment, not just capital.

This shift has broad implications. For crypto projects, this could be a potential reset in how they raise capital, build a community, and go to market. For retail investors, it opens up earlier access to new projects with more transparent terms. For institutions, it may require a rethink of how to participate competitively in fundraising rounds that prioritize community involvement over capital size and brand recognition. If this trend persists, the next generation of token launches could look more like open networks than closed capital tables.

How We Got Here: From ICO Mania to the Airdrop Meta

The 2017 ICO boom unlocked a wave of capital and experimentation. Ethereum’s own launch in 2014, raising $18 million in a public sale, set the precedent. In the years that followed, projects like EOS ($4.2 billion), Filecoin ($200 million), and Brave ($35 million in 30 seconds) raised staggering sums from the public. ICOs offered early access to protocols that would eventually become core infrastructure for crypto. The model felt revolutionary, until it wasn’t.

With minimal oversight, the gold rush quickly turned into a credibility crisis. By mid-2018, more than 80% of ICOs were either scams or failures, prompting a swift crackdown from U.S. regulators. The SEC led the way with a plethora of enforcement actions, chilling public token fundraising across the industry.

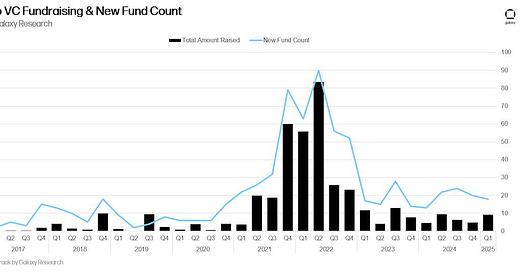

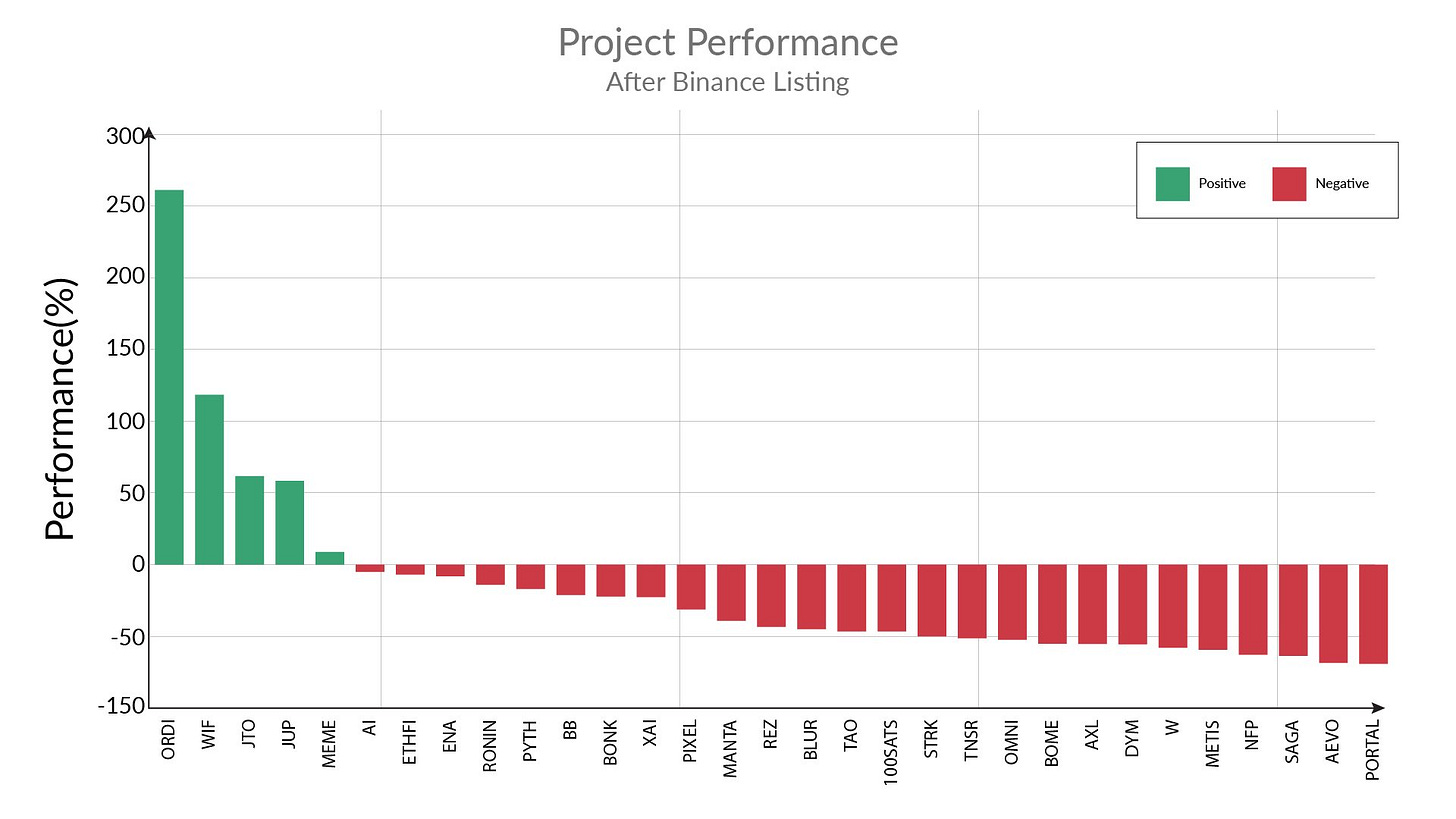

The model shifted. Token launches moved behind closed doors, driven by COVID-induced low interest rates and ample venture capital. Projects began raising in private rounds at low valuations, only to list publicly at orders of magnitude higher fully diluted valuations (FDV) with low circulating supply. Retail was left with delayed access and limited upside, effectively serving as exit liquidity. For many, the model has proven extractive and misaligned.

Airdrops emerged as a workaround. They avoided securities issues by distributing tokens to users, often tied to points campaigns or past activity. But this too had tradeoffs: bot farming, sybil attacks, and rapid sell-offs undermined long-term community building.

Most airdrops failed to generate sticky users or durable market value, although there have been rare exceptions. Hyperliquid, for instance, managed to align incentives with active contributors and has maintained strong product-market-fit, engagement, and token performance post-launch.

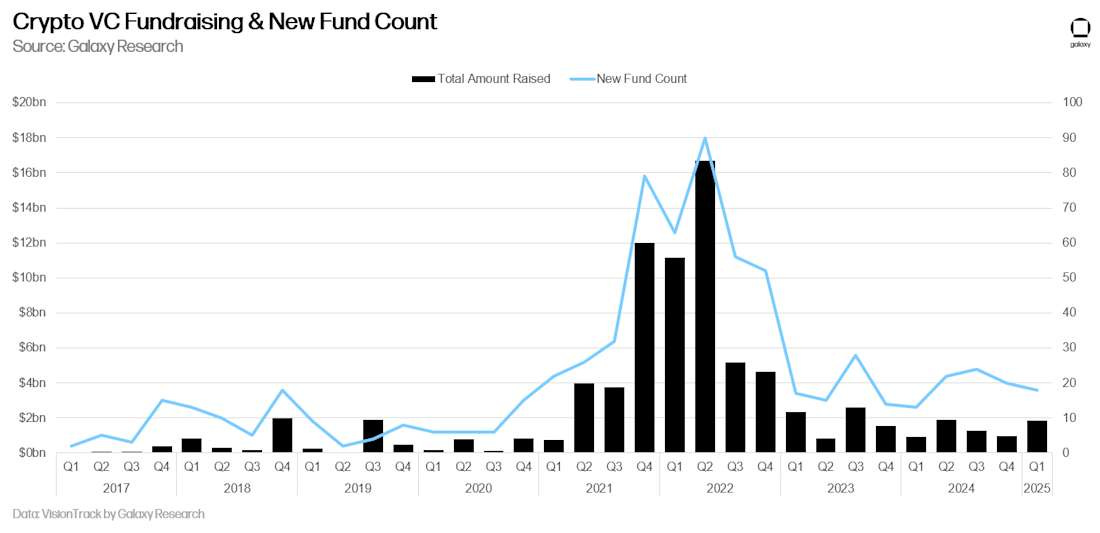

By the end of 2024, the market was already showing signs of fatigue. Low-float, high-FDV launches struggled to hold value (we’ve all see the token listing performance data). Retail sentiment soured. And a growing number of founders began asking a fundamental question: what if we brought ICOs back, but did it differently this time?

The Catalyst: Changing U.S. Regulation

The resurgence of public token fundraising in 2025 is no accident, it’s fueled by a seismic shift in U.S. crypto regulation, moving from enforcement-heavy tactics to a more collaborative and innovation-friendly framework.

Ripple Case Resolution

In January 2025, acting SEC Chairman Mark Uyeda launched the Crypto Task Force, led by Commissioner Hester Peirce, to develop a comprehensive and clear regulatory framework for crypto assets. Unlike the prior administration’s reliance on enforcement actions (over 70 between 2013-2022), the Crypto Task Force prioritizes clear rules, realistic registration paths, and tailored disclosures.

By May 2025, the SEC had hosted multiple roundtables on tokenization, custody, and trading, signaling a proactive approach to industry input. New SEC Chair Paul Atkins, sworn in April 2025, doubled down, criticizing past regulatory uncertainty and pledging guidelines for token issuances and potential exemptions for decentralized projects.

Landmark Legal Resolutions

The SEC’s March 2025 decision to drop its lawsuit against Ripple Labs, ruling XRP as a non-security, removed a major barrier for public token sales.

Similarly, the SEC paused high-profile enforcement cases against Coinbase, Kraken, and others, reflecting a de-prioritization of litigation in favor of rulemaking. The February 2025 dismissal of charges against Coinbase, America’s largest crypto exchange, underscored this shift.

Policy and Legislative Momentum

President Trump’s January 2025 executive order, “Strengthening American Leadership in Digital Financial Technology,” established a working group to propose crypto regulations within six months, alongside a Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile.

Congressional efforts, including the Financial Innovation and Technology for the 21st Century Act (FIT21), aim to clarify SEC and Commodity Futures Trading Commission (CFTC) roles, with bipartisan support growing under crypto-friendly leaders like Senator Cynthia Lummis.

A cornerstone of this momentum is the proposed “token safe harbor,” championed by Hester Peirce since 2020 and gaining traction in 2025. While far from a blanket exemption - any legitimate token sale that functions as a true capital-raising event could still fall under securities laws or require a separate exemption - this framework would grant certain blockchain projects a three-year exemption from certain securities regulations, provided they meet disclosure requirements and demonstrate progress toward decentralization. By reducing the immediate burden of securities registration, the safe harbor lowers legal and financial barriers for startups, enabling more projects to launch public token sales without fear of SEC enforcement.

For example, early-stage protocols could issue tokens to fund development, attract community participation, and bootstrap networks, mirroring Ethereum’s 2014 ICO but with guardrails like mandatory transparency and anti-fraud measures.

By fostering a predictable regulatory path, the safe harbor could unleash a wave of ICOs, particularly for smaller teams excluded from VC-dominated private rounds, democratizing both fundraising and retail access.

Mature Centralized Exchanges as On-Ramps

The evolution of centralized exchanges (CEXs) into sophisticated, TradFi-integrated platforms is amplifying the ICO resurgence by potentially serving as seamless on-ramps for both crypto-native and traditional investors.

By 2025, CEXs like Binance, Coinbase, and Kraken have matured significantly, boasting robust technology (e.g., sub-millisecond matching engines, advanced custody solutions) and deep integrations with traditional finance, such as fiat on-ramps, banking partnerships, and compliance with KYC/AML standards. This maturity could enable CEXs to host or facilitate ICOs, bridging the gap between crypto’s retail base and institutional capital.

Coinbase stands out with its Base Layer-2 network, with nearly $4 billion in total value locked (TVL) and over$1 billion daily DEX volume, and Verified Pools, a set of KYC-verified liquidity pools built on Base and the Uniswap v4 protocol, designed to enhance security and compliance in DeFi trading.

Base processed over $102 billion in DEX volume in Q1 2025, making it an ideal platform for on-chain token sales with scalable, gas-efficient mechanics. Furthermore, Verified Pools allow projects to control participant access (e.g., via KYC or reputation scores), ensuring compliant ICOs while leveraging decentralized infrastructure.

For instance, a Base-hosted ICO could use Verified Pools to whitelist accredited investors or vetted community members, blending DeFi’s transparency with CEX-grade oversight. Coinbase’s integration with traditional finance, through FDIC-insured banking partners and custodial services, further enables TradFi users to participate, converting fiat to tokens with ease.

Practical Impacts

The rescission of Staff Accounting Bulletin No. 121 (SAB 121) in January 2025 alleviated burdensome accounting rules for crypto custodians, enabling banks and firms to expand digital asset services. The SEC’s April 2025 guidance clarified disclosure requirements for crypto securities, addressing risks like price volatility and cybersecurity while encouraging compliant offerings. These changes empower projects to launch public sales with reduced legal risks, attract institutional capital, and rebuild retail trust.

The Next Wave of Fundraising: Open, Aligned, and On-Chain

As the regulatory fog begins to lift, a new generation of fundraising models is gaining traction. These aren’t your 2017 ICOs, they’re more structured, more transparent, and, crucially, more aligned with community participation.

Reputation-Based Access

Platforms like Legion and Echo are redefining how early-stage access is granted. Instead of allocating based purely on wallet size or insider status, these platforms use reputational elements, built on social presence, on-chain behavior, and developer contributions, to prioritize participants who add value.

This is a meaningful shift. For the first time, individual contributors, power users, and even independent researchers can earn access to token sales on merit, not connections. It’s a break from the airdrop era’s sybil-prone point farming and the VC era’s gated rounds.

Compliant Token Sales

With Europe’s MiCAR framework and renewed U.S. policy momentum, projects are increasingly opting for regulatorily compliant community sales. Legion, for instance, is building around MiCAR’s disclosures and KYC requirements, while Echo takes inspiration from AngelList’s syndicate model but runs it fully on-chain.

Some launches now resemble structured public offerings more than hype-driven drops: fixed allocations, whitelisted participants, and clear terms. Pulse, MegaETH, and several DePIN projects have raised millions using these platforms, often in minutes.

AI-Driven Fairness and Automation

Experiments like AI Pool are pushing the boundaries even further. Built on Trusted Execution Environments (TEEs), which are secure, isolated processing areas within a device that protect sensitive operations, these autonomous agents can custody funds, manage token distribution, and even set auction pricing, all without human interference. The end goal? Eliminate the possibility of insider games, MEV sniping, or rug pulls entirely.

While still experimental, the rise of AI-driven ICOs (AICOs) shows that teams are serious about rebuilding public trust in token sales and leveraging technology to do so.

What’s Replacing Airdrops

This new wave doesn’t fully eliminate airdrops but has the potential to reframe them. Rather than retroactive point farming, many projects are leaning into pre-token community sales, where aligned participants commit capital early. These models foster stronger ownership and reduce sell pressure, a lesson learned from successful launches like Hyperliquid, where community engagement and well-timed distribution drove sustained performance.

InfoFi platforms like Kaito are further transforming the airdrop meta by leveraging AI to analyze on-chain behavior and social engagement, rewarding genuine contributors with targeted token allocations. This data-driven approach minimizes bot-driven farming and aligns incentives with long-term community value.

What This Means for the Market

The return of public token sales isn’t just a throwback, it’s a reconfiguration of how capital, community, and control interact in crypto.

For retail investors, it’s a long-overdue reset. The new wave of ICOs offers earlier, fairer access to promising projects, often with transparent mechanics and measurable contribution-based criteria. It’s no longer about catching a tweet in time or hoping for an airdrop. It’s about showing up, adding value, and earning your way in.

For institutions, this presents both a challenge and an opportunity. Legacy VC models that relied on low-float, high-FDV deal structures may struggle in a cycle that values alignment over capital size. But forward-looking funds, those willing to engage publicly, accept on-chain transparency, and build credibility with communities, will likely thrive.

The return of ICO-style public fundraising introduces more than a new narrative, it introduces a different market structure. One that blurs the lines between community and capital, investor and user, liquidity and price discovery.

For market makers, especially those operating at the intersection of crypto and TradFi, this presents both a challenge and a strategic opportunity.

In the previous cycle, market makers were often brought in post-token generation events (TGE), essentially tasked with ensuring order book depth and price alignment on centralized and decentralized exchanges. But as public fundraising re-emerges through mechanisms like fixed-price sales, clearing-price auctions, and on-chain liquidity bootstrapping, the role of the market maker shifts forward in the lifecycle:

Pre-launch liquidity strategy: With token launches returning to transparent, public formats, market makers can engage earlier, modeling optimal liquidity parameters, helping teams avoid manipulation-prone setups, and ensuring pricing integrity across Automated Market Makers (AMM) and CEXs.

Reputation and alignment: In systems like Legion, where community sales are gated by on-chain reputation, market makers may also be selected based on track record, alignment with community goals, and cross-market experience — not just fee structures.

Cross-market continuity: Projects that aim to list on both DEXs and CEXs will increasingly need market makers who can bridge liquidity and execute across fragmented venues, from on-chain auctions to centralized listings. This favors market makers with TradFi-grade infrastructure and crypto-native agility.

Advisory edge: As launch formats diversify, token issuers will need partners who can advise on liquidity provisioning, slippage protection, and post-launch stabilization, especially for assets debuting in highly retail-accessible, globally distributed formats.

Ultimately, the capital stack in crypto is being rebuilt. The lines between user, investor, and contributor are blurring. Those who understand this shift, and position accordingly, will define the next market cycle.

Disclaimer

This content (“content”) has been prepared by Flow Traders B.V. and its affiliates (“Flow Traders”) for informational and educational purposes only. Content prepared by Flow Traders is addressed exclusively to professional and institutional investors (i.e. eligible counterparties) residing in eligible jurisdictions.

Please refer to our full disclaimer here.