Tokenization in Capital Markets: A Market Maker’s Perspective

TL;DR

Tokenization unlocks efficiencies like instant settlement, 24/7 trading, and fractional ownership—but real-world adoption depends on solving infrastructure and regulatory challenges, not just technology.

Market makers face key friction points in tokenized markets: fragmented liquidity requiring pre-funding across blockchains, lack of product-market fit without real demand, and operational complexity from 24/7 trading.

Stablecoins succeeded because of simplicity, open access, and clear use cases in payments and crypto trading; tokenized money market funds are slower to grow due to compliance burdens and less obvious utility.

A common misconception is that market makers can manufacture liquidity out of thin air—when in reality, they rely on demand, legal clarity, and reliable settlement rails to operate effectively.

Tokenization’s future hinges on fixing infrastructure—cross-chain interoperability, legal certainty, investor access, and better tooling—before it can meaningfully scale in capital markets.

Tokenization in Capital Markets: A Market Maker’s Perspective

Tokenization – the creation of digital tokens to represent real assets – is gaining serious traction in capital markets and industry leaders are heralding it as the next big evolution in finance. BlackRock CEO Larry Fink recently predicted “the next generation for markets, the next generation for securities, will be tokenization of securities,” highlighting benefits like instantaneous settlement and lower fees by cutting out middlemen.

In simple terms, tokenization means putting assets (like stocks, bonds, real estate, etc.) on a blockchain so ownership can be transferred with cryptographic proof. This concept promises to increase efficiency, liquidity, and accessibility in ways traditional market infrastructure struggles to match.

But how does this look from the perspective of a market maker – those liquidity providers who stand ready to buy and sell?

This article breaks down tokenization’s appeal and challenges in plain language. We’ll explore why tokenization is exciting, then examine three key friction points that market makers see in tokenized markets. We’ll compare the success of stablecoins vs. tokenized money market funds, clarifying why one exploded in use while the other is only just emerging.

We’ll also address common misconceptions about what market makers can and cannot do (spoiler: they can’t magically fix infrastructure gaps or generate trading demand out of thin air). Finally, we discuss the realistic role market makers do play in fostering these new markets – providing liquidity, aiding price discovery, and connecting venues – and what tokenization needs to succeed going forward.

Why Tokenization Is Gaining Traction

Capital markets are paying close attention to tokenization for good reason. The excitement isn’t just crypto hype – it stems from concrete efficiencies and new capabilities that tokenization can unlock.

First, it can dramatically speed up and simplify settlement. Today, a stock or bond trade might take 2 days (also known as t+2 in the industry) to fully settle; with tokens, settlement can be near-instant and peer-to-peer, reducing counterparty risk and cost.

Second, tokenization enables 24/7 trading and global accessibility. Unlike traditional markets tied to local business hours, a tokenized asset can, in theory, trade anytime and reach a broader base of investors around the world.

Third, it allows fractional ownership and programmability. A large asset (like real estate or a bond) can be broken into smaller token shares, lowering barriers to ownership. Smart contract code can be embedded into tokens, automating compliance or corporate actions.

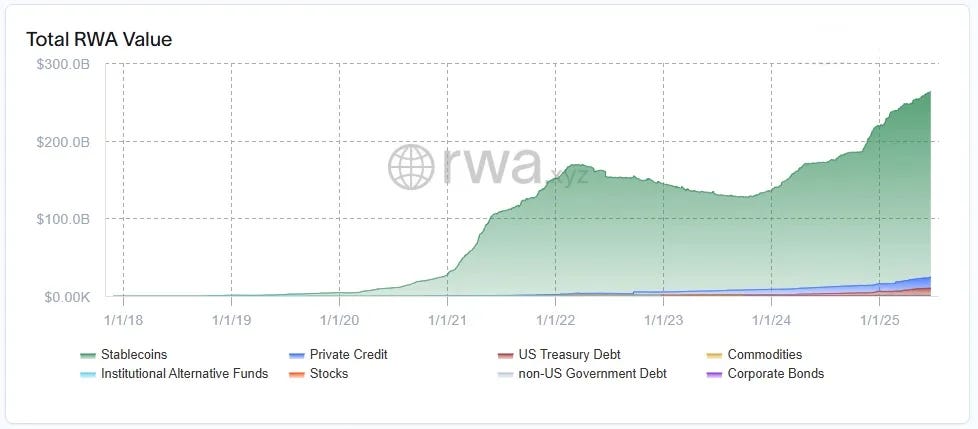

Stablecoins are the clearest early success, regularly facilitating trillions in transaction volume as digital cash in the crypto ecosystem. Tokenized U.S. Treasury and money market funds surpassed $7 billion in value as of mid 2025, offered by firms like BlackRock, WisdomTree, and Franklin Templeton.

The Market Maker’s Puzzle: Key Friction Points

From a market maker’s perspective, tokenized markets have several puzzle pieces that all need to fit together: market design, investor demand, capital efficiency, and infrastructure.

Three core friction points stand out:

1. Capital Efficiency – Fragmented Liquidity and Funding Constraints

Tokenized markets are fragmented across blockchains and venues, requiring market makers to pre-fund capital at each location. Pre-funding refers to the requirements for market participants to fully deposit and lock capital on each blockchain or trading venue in advance in order to provide liquidity. There’s no unified prime brokerage or credit system like in TradFi. This increases cost and reduces flexibility.

In TradFi, market makers can access prime broker relationships, allowing centralized margin and financing across exchanges and instruments. In tokenized markets, they must “park” assets in each protocol, blockchain, or custodial venue – tying up capital and limiting arbitrage. And in the absence of a central counterparty, market makers often bear full settlement risk unless bilateral trust is established.

A typical example: to provide liquidity on both Uniswap on Ethereum and a tokenized U.S. Treasury protocol on Stellar, a market maker needs to hold funds in both ecosystems, with separate wallets, custody rules, and technology integrations. If the spreads and volume don’t justify the funding cost and operational risk, participation is unlikely.

2. Product-Market Fit – Without Real Demand, Liquidity Dries Up

Tokenization, however, doesn’t automatically create interest. Just because an asset is represented on-chain doesn’t mean it will be widely traded. If investors don’t want or understand the asset, or face legal barriers, market makers cannot generate volume.

For example, some tokenized real estate or bond projects have struggled due to:

Low accessibility (accredited investors only)

Complex onboarding/KYC processes

Poor user experience or wallet support

Lack of yield or utility compared to alternatives

In contrast, stablecoins thrived because they offered clear utility: transferring value, settling trades, and accessing DeFi. Tokenized assets need similarly compelling use cases to attract both buy-side demand and liquidity.

3. 24/7 Market Design – Operational and Risk Complexity

Always-on markets sound good in theory but create real challenges. Market makers must manage risk and liquidity during off-hours, when banks and other infrastructure might be offline. Volumes also tend to be thin on weekends, creating volatility rather than efficiency.

Unlike equity markets, which close overnight and on weekends, tokenized assets can trade anytime. While this increases flexibility, it adds pressure on market makers to monitor exposures around the clock. Price gaps, flash crashes, and liquidity voids become more likely, especially without robust participation and tools.

In TradFi, centralized clearing and circuit breakers help reduce these risks. In decentralized or hybrid tokenized markets, those protections may be absent or inconsistent across platforms.

Stablecoins vs. Tokenized Money Market Funds: A Tale of Two Tokenizations

To illustrate the above points about demand and markets structure, consider the difference between stablecoins and tokenized money market funds - two forms of tokenized dollar-based assets.

Both are tokenized representations of U.S. dollar assets – but, so far, their adoption diverged sharply. The following comparison highlights the importance of usability, regulation, and market design.

Stablecoins (e.g., USDT, USDC):

Pegged to the U.S. dollar, backed by reserves (like cash or short-term Treasuries)

Freely transferable on public blockchains

Used extensively in crypto trading, payments, and DeFi

Market cap exceeds $240 billion

Trillions in on-chain transfer volume annually

Tokenized Money Market Funds (MMFs):

Represent shares in SEC-registered funds holding T-bills or repurchase agreements

Typically permissioned, KYC-only, and not freely transferable

Offered by large institutions (e.g., Franklin Templeton, BlackRock, WisdomTree)

Total market size under $8 billion as of Q2 2025

Why did stablecoins succeed while tokenized MMFs lagged?

Access and Friction: Stablecoins are open and simple to use. Anyone with a wallet can receive or send them. Tokenized MMFs are permissioned, require onboarding, verification, and use of specific platforms or custodians.

Use Case Fit: Stablecoins solve real problems in crypto – fast transfers, global payments, and access to DeFi. Tokenized MMFs don’t yet have a clear killer application.

Regulatory Arbitrage: Stablecoins have operated in a regulatory grey zone, allowing faster growth. Tokenized MMFs must follow full securities rules, slowing adoption.

In summary: stablecoins delivered on convenience and liquidity in a largely unregulated environment, aligned with the needs of crypto markets. Tokenized MMFs, on the other hand, are now integrating TradFi into the digital asset landscape – offering something arguably better (yield with stability and legal investor protections), but with more initial friction (compliance hurdles, less obvious use cases in DeFi so far).

It’s telling that stablecoins became popular as a payment and trading medium, not as an investment – they play a critical role in ensuring the functioning of crypto markets. Tokenized MMFs are investments first; their utility comes from earning yield or being used as collateral, which is a slightly more complex value proposition to communicate and integrate.

That said, the gap may close in coming years. As mentioned, regulations like Europe’s MiCA and the US Stable Act are formally splitting the space: stablecoins will remain non-yielding transaction tokens, while yield-seeking capital is expected to flow into tokenized money market funds.

Major asset managers and DeFi platforms are collaborating to make these fund tokens more usable – for instance, allowing them as collateral in lending protocols, or enabling same-day settlement of redemptions. The excitement is that a tokenized MMF could eventually combine the scale and utility of stablecoins with the safety and yield of traditional funds. But getting there will require building demand (perhaps through fintech apps that let users seamlessly hold such tokens) and proving the market design (ensuring liquidity is there when people want to enter or exit).

As of now, stablecoins remain dominant in on-chain liquidity, while tokenized funds are an emerging niche – promising, but not yet realized at scale.

Misconceptions About Market Makers in Tokenized Markets

Tokenized asset discussions often overestimate what market makers can do. Two common misconceptions stand out:

Myth 1: “Market makers will create liquidity if we build the asset.”

Reality: Market makers can quote prices, but they can’t force people to trade. Without investor interest or clear use cases, liquidity will be shallow and short-lived. Market makers respond to economic incentives. They quote tighter spreads and deeper liquidity where there is consistent volume and lower risk. If a tokenized bond trades once a week with a 1% bid-ask spread, it’s not viable for efficient market making. From this perspective, liquidity is no substitute for an unappealing product that does not solve a user’s problem.

Myth 2: “Market makers can bridge all the gaps between TradFi and DeFi.”

Reality: Like other market participants, market makers are users of infrastructure. They rely on custodians, exchanges, wallets, legal clarity, and counterparty trust. They can provide feedback and request improvements, but they can’t fix regulatory uncertainty or integrate legacy rails. They need clarity on how settlement works, how disputes are resolved, and how capital can move.

The Role of Market Makers in Tokenized Asset Markets

Despite these limitations, market makers play an important role in maturing tokenized markets – if the core infrastructure and incentives are in place. Three contributions stand out:

1. Providing Liquidity

Market makers can offer continuous two-sided quotes, helping reduce bid-ask spreads and enabling execution even when there’s no immediate counterparty. This is especially important in early-stage markets with few natural buyers and sellers.

On decentralized exchanges (DEXs), market makers can supply liquidity via automated market maker (AMM) pools or hybrid central limit order book (CLOB) or request for quote (RFQ) mechanisms. On centralized platforms, they use traditional order books and algorithmic strategies.

2. Supporting Price Discovery

By actively quoting and adjusting prices in response to supply and demand, market makers help establish a fair value for tokenized assets. This price transparency is crucial for investor confidence and secondary trading.

In some markets, market makers also help normalize prices across venues – identifying and arbitraging discrepancies between exchanges or blockchains, promoting consistency and fairness in prices.

3. Bridging Venues and Assets

Tokenized markets often emerge in silos. Market makers help stitch them together – connecting tokenized Treasuries on one platform with demand on another, or linking assets across Ethereum, Solana, Polygon, and Layer 2s.

They also provide feedback to issuers and infrastructure providers on what’s needed: better APIs, faster settlement, more flexible custody, and aligned incentives.

Leading market makers are already building capabilities to support this evolution:

24/7 infrastructure – algorithmic risk management systems that monitor positions and pricing across regions and time zones.

On-chain settlement – using stablecoins or digital cash for on-chain trade settlement without needing traditional bank rails.

Cross-chain connectivity – bridging liquidity across Ethereum, Solana, Layer 2s, and permissioned chains, with active inventory and wallet management.

Asset onboarding frameworks – evaluating tokenized asset projects based on expected volume, legal clarity, counterparty risk, and venue support.

This mirrors what they do in other asset classes – adapting to new venues, pricing models, and client flows – but with added technical and regulatory complexity and novelty.

The Road Ahead: What Tokenization Needs to Succeed

Tokenization is no longer a “cool experiment.” It’s real. But it needs robust infrastructure, legal clarity, and genuine market participation to scale.

According to the World Economic Forum, the biggest hurdles include:

Integration with legacy systems – TradFi still relies on central securities depositories, custodians, and T+2 settlement. Seamless interoperability is essential.

Cross-platform interoperability – Tokenized assets should be movable across blockchains and venues, avoiding liquidity fragmentation.

Clear legal and regulatory frameworks – Market participants need to know what rights the tokens confer, how disputes are resolved, and what rules apply.

Privacy and compliance – Institutions require identity screening, audit trails, and confidentiality – not always present in public blockchain settings.

Market quality and participation – Without reliable secondary market liquidity, investors won’t commit significant capital. That means better incentives, tooling, and market-making support.

Ultimately, tokenization must solve real problems better than the status quo. That means faster settlement, lower fees, broader access, or novel product features – not just “putting things on a blockchain” for its own sake.

Conclusion: Tokenization Is 90% Infrastructure

There is a common mantra in this space:

tokenization is 90% infrastructure, 10% technology

The tech works today. What’s missing is market design, plumbing, and ecosystem alignment. Success comes when:

Investors can access it easily and legally

Settlement is efficient and trusted

Liquidity providers can operate across venues and time zones

Regulators understand and support the structure

Infrastructure enables capital efficiency and risk management

Tokenization promises to reshape capital markets, but it’s still early. Market makers will play a key role in fostering these ecosystems, just as they have in FX, equities, ETFs, and crypto. But success will come from collaboration across the stack: issuers, venues, custodians, regulators, and liquidity providers.

When tokenized assets can trade on a Saturday night with the same confidence and participation as Monday morning, the vision will be realized.

Disclaimer

This content (“content”) has been prepared by Flow Traders B.V. and its affiliates (“Flow Traders”) for informational and educational purposes only. Content prepared by Flow Traders is addressed exclusively to professional and institutional investors (i.e. eligible counterparties) residing in eligible jurisdictions.

Please refer to our full disclaimer here.